The Force for Good Fund invests in women and people of color-owned,“Best for the World” B Corporations (i.e., companies that score in the top 10% of B Corps worldwide).

Our Investees:

“The Force for Good Fund is a refreshing and promising new platform that advances the values and importance of companies designed to create an outsized beneficial impact. I invested because I believe this is a catalytic opportunity for the advancement of our field.”

Our Donors:

A Few of Our 100+ Investors:

Overview + FAQ:

Q: What is this project all about?

B Corps are a growing community of more than 2,200 companies--including Patagonia, Ben & Jerry’s, Seventh Generation, and Eileen Fisher--that aspire to use the power of business to solve social and environmental problems.

The Force for Good Fund is designed to help nurture, support, and grow women and people of color-owned, high-impact, “Best for the World” B Corporations (i.e., companies that score in the top 10% of B Corps worldwide).

This fund is needed because it is incredibly difficult for early-stage, socially and environmentally responsible businesses run by women and people of color to access non-extractive capital.

The support services are also needed because the decisions that entrepreneurs make very early in the life of the company (e.g., where to seek financing, who to choose as their suppliers, who to hire, how to split equity/ownership, etc.) can severely restrict the company’s ability to maximize its positive impact over the long term.

The Force for Good Fund is an innovative opportunity to support these early-stage entrepreneurs with the guidance, access to capital, and connections they need in order to be successful.

Q: What are the latest updates?

Successfully raised $1.1M from 125 investors

$400k raised via investment crowdfunding in 2016

$700k raised from accredited investors in 2017

Invested in 13 businesses by early 2018

Currently raising $50k in charitable donations to help support the fund. Want to help? Click here to donate to the project!

Q: CAN YOU TELL US MORE ABOUT THE INVESTEES?

Here are descriptions and contact information for the 13 women and people of color-owned businesses we invested in:

1) Spotlight Girls (Oakland, CA)

Multimedia platform and summer camp that aims to educate, inspire, and activate girls and women to take center stage

Lynn Johnson: lynn@spotlightgirls.com

2) The Town Kitchen (Oakland, CA)

Healthy, chef-crafted lunch delivery that provides training and jobs for underserved youth

Natalia Carrasco: natalia@thetownkitchen.com

3) Community Services Unlimited (Los Angeles, CA)

South LA’s first organic produce market and local food hub

Neelam Sharma: neelam@csuinc.org

4) 10Power (Haiti and San Francisco, CA)

Financing renewable energy in developing communities

Sandra Kwak: sandra@10pwr.com

5) Our Table Cooperative (Sherwood, OR)

Muti-stakeholder cooperative farm that is helping to create a resilient and interdependent local food culture

Narendra Varma: narendra@ourtable.us

6) Tanka Resilient Agriculture (Pine Ridge Indian Reservation, SD)

Returning buffalo to the lands, lives, and economy of Indian People

Mark Tilsen: mtilsen@tankabar.com

7) Owíŋža Quilting Cooperative (Pine Ridge Indian Reservation, SD)

Supporting self-determination, self-sufficiency and cultural identity through a social enterprise that creates and sells handcrafted Lakota star quilts

Erin Anderson: erin@thudervalley.org

8) CA Fibershed Cooperative (San Geronimo, CA)

Promoting the use and production of regionally grown materials. Supporting our community to enhance and restore our soil, water, and the health of the biosphere

Stephany Wilkes: stephany.wilkes@gmail.com

Rebecca Burgess: harvestingcolor@gmail.com

9) The Guild (Atlanta, GA)

Creating intentional spaces where diverse changemakers can thrive, collaborate with peers, and build community

Nikishka Iyengar: nikishka.iyengar@gmail.com

10) Preserve Farm Kitchens (Petaluma, CA)

Supporting local farms by making preserved, gourmet foods from produce that might otherwise go unsold or go to waste

Merrilee Olson: molson@preservefarmkitchens.com

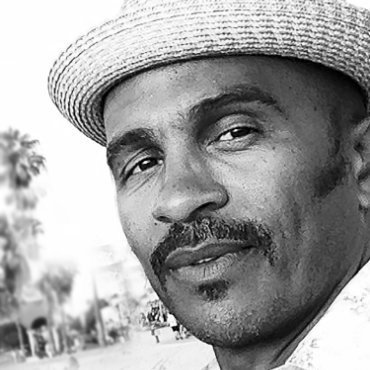

11) Red Bay Coffee (Oakland, CA)

We envision a world in which coffee is a vehicle for inclusion, social and economic empowerment, entrepreneurship, innovation, and environmental sustainability

Keba Konte: keba@redbaycoffee.com

12) Main Street Project (Northfield, MN)

Developing a poultry-centered regenerative agriculture system that can change how food is produced around the world

Julie Ristau: jristau@mainstreetproject.org

13) East Bay Permanent Real Estate Cooperative (Oakland, CA)

Developing cooperative, affordable real estate alternatives that empower people to create intentional communities that are ecologically, emotionally, spiritually, culturally, and economically regenerative

Janelle Orsi: janelle@theselc.org

Q: Who will run the Force for Good Fund?

The team at LIFT Economy, with support from a broad network of mentors, allies, and community partners. The fund is housed within the not-for-profit organization Community Ventures.

Q: Can I donate to this project?

Yes! To make a charitable donation to our loan-loss reserve, please visit: www.razoo.com/story/Force-For-Good-Fund. You can also reach out to Jenny Kassan at jenny@jennykassan.com with any questions.

Q: What are the top 5 reasons I should DONATE to this fund?

This fund is important for several reasons, including:

1. Democratizing Capital:

We successfully crowdfunded over $400k during our initial fundraising campaign from September 7 - November 7, 2016. This allowed anyone to invest as little as $1k. We then raised $700k from accredited investors by Summer 2017.

2. Diversity and Inclusion:

There are not enough female entrepreneurs and entrepreneurs of color in the socially responsible business community. At a minimum, 51% of all companies who participate in the Force for Good Fund must be owned by women. Similarly, at least 51% of all participating companies must be owned by people of color. These are both minimum requirements, not the maximum.

3. Climate Change Solutions:

Global warming has become too powerful of a threat to ignore. Companies that have a business model that is specifically designed to mitigate the negative effects of climate change (e.g., regenerative agriculture, carbon sequestration, alternative energy, eco-literacy, etc.) will be given preference for participation in this project.

4. Capital + Services:

Giving a company money and hoping for the best has had mixed results. The Force for Good Fund combines investment capital with a year of consulting services to help entrepreneurs work on their vision, culture, strategy, and operations. These support services are needed because, among other things, the decisions that entrepreneurs make very early in the life of the company (e.g., where to seek financing, who to choose as their suppliers, who to hire, how to split equity/ownership, etc.) can affect the company’s ability to maximize its positive impact over the long term.

5. The Global B Corp Movement:

The B Corp movement provides this fund with a few important tools. First, all participating companies will get assistance in becoming a Certified B Corporation (with a goal of becoming “Best for the World” B Corporations). Second, investees will receive support in incorporating stakeholder interests into their foundational legal documents (e.g., incorporating as benefit corporations) within one year. Finally, participants will be connected to a thriving network of over 2,500 B Corp mentors, potential suppliers, and referral partners to help them dramatically enhance their chances of long-term success.

Q: WHAT IS THE BACKSTORY / HISTORY BEHIND THIS PROJECT?

First Fund Concept

In late 2014, Kevin Bayuk told Ryan Honeyman that he was thinking about starting a fund. He said that many of LIFT's earlier stage, high-impact clients desperately needed consulting assistance (especially shoring up their business fundamentals), but that they couldn't afford to pay LIFT Economy to help them.

Kevin said that he (and his business partner Shawn Berry) had decided to help many of these high-impact clients on a pro-bono basis. Kevin and Shawn believed that society needed more models of next economy businesses. However, it was not financially sustainable for LIFT's partners to work pro-bono for a large percentage of clients.

Kevin's question to Ryan was "what if we could raise capital, seek out some of the most inspirational businesses on the planet, and bring our own funding to the table to help them improve their social, environmental, and financial performance?"

Shift to a B Corp Fund

When Kevin told Ryan this story, his first response was "that sounds great. What if we made it a B Corp fund?" Ryan's thought was that LIFT could help investees certify as B Corps, get investees connected to mentors and/or supply chain partners in the B Corp movement, and help the B Corp movement itself be more inclusive. It would be a win/win/win proposition.

However, the LIFT team decided that they didn't want to invest in "any old B Corp." LIFT wanted to focus on investing in women and people of color owned, ultra high-impact, "Best for the World" B Corps (e.g., those companies that score in the top 10% of B Corps worldwide). The idea was that these "Best of the Best" companies would help provide a model for the next economy.

When Jenny Kassan joined LIFT Economy in the fall of 2015, she played a critical role in helping the team think about how to raise capital for the fund in the most non-extractive way.

Setting up a Non-Extractive Fund

One assumption the LIFT team wanted to challenge was the requirement of growth. For example, most venture capital firms are setup to invest in high-growth companies. Even if a company is "mission-driven" in the beginning, the expectations that come with venture capital means that investees are expected to rapidly scale for roughly 5-7 years, then "exit" (in order to pay back investors) by either 1) getting bought by a bigger company, or 2) going public. It is incredibly hard to maintain a company's original social and environmental mission with these expectations.

Over the past 10-15 years, impact investing has tried to have rapidly scaling companies, but those that have a dual benefit for shareholders and other stakeholders (e.g., DBL Partners, Bridges Ventures, Bain Capital's new "Dual Impact" fund, etc.).

The LIFT team believes, however, that even rapidly scaling impact investing funds that create outsized returns for investors are not what is needed for the next economy. The vast majority of these investors overlook many amazing companies that don't want to grow for growing's sake.

Launching Our Crowdfunding Campaign

Another assumption the LIFT team wanted to challenge is that we should only be raising funds from wealthy (or "accredited") investors. More than 95% of the population of the United States is not accredited. We wanted to democratize capital by raising money from the average person (in increments of as little as $1,000). Indeed, Kat Taylor was particularly excited about our fund because it was focused on democratizing capital.

We launched our crowdfunding campaign on September 15, 2016 at the SOCAP conference in San Francisco. We had a modest goal of raising $100k in two months. We ended up raising over $400k from ~100 investors by mid-November 2016. We have investors ranging from the Jodie Evans of CODE PINK, to Vincent Stanley from Patagonia, to Leslie Christian of NorthStar Asset Management, to a Managing Director at BlackRock (who invested $50k out of nowhere).

Accredited Raise and Making Investments

After raising $400k via crowdfunding, we successfully raised another $700k from accredited investors (for a total of $1.1M) by the summer of 2017. We then deployed our $1.1M in investments to 13 amazing organizations led by women and people of color.

Q: How do I learn more and get involved?

To stay up to date about the Force for Good Fund, please sign up for our monthly newsletter.

We are in need of charitable donations--please visit www.bit.ly/donateffg to learn more. You can also email shawn@lifteconomy.com with any questions.